Owning a collector car is more than a vehicle investment—it’s a passion and a treasure that requires unique care and protection. Whether it’s a restored vintage classic, a high-value exotic, or a rare antique, owning a collector car comes with a distinctive set of responsibilities, including finding the right insurance. Collector auto insurance is specifically designed to address the needs of vintage, classic, and exotic vehicle owners, offering tailored coverage options and acknowledging the unique value of these cars.

This guide will explore the importance of collector auto insurance, its various coverage types, factors affecting premiums, tips for choosing the right policy, strategies for saving on premiums, and insights into the claims process. Additionally, we’ll provide answers to some frequently asked questions to help you better understand how to protect your collector vehicle.

Why Collector Auto Insurance Is Important

Collector cars are not like everyday vehicles. Their higher value, unusual usage patterns, and the availability of spare parts or repairs make them unique. Here's why specialized collector car insurance is essential:

1. Protection of High-Value Assets

Collector cars are often worth far more than their original value. Regular auto insurance policies may not account for this, which could result in financial loss if the car is damaged or totaled. Collector auto insurance assesses your vehicle's agreed-upon value, ensuring proper compensation.

2. Tailored Coverage Options

Standard auto insurance policies are built for daily drivers, but collector cars are typically used less frequently and might even spend most of the time in storage. Collector car insurance policies accommodate such usage patterns by offering specific coverage terms that match the needs of limited-use vehicles.

3. Preservation of Investments

Your collector car is not just a hobby—it’s an investment. Insurance protects against risks like accidents, theft, or natural disasters, helping to preserve the value of your asset.

4. Compliance and Legal Requirements

While not all states require collector-specific policies, having adequate liability coverage for your classic car is a legal necessity. Without it, you could face fines or legal issues if an accident occurs.

5. Peace of Mind

Whether you’re taking your classic Mustang to a local car show or storing it for the winter, having the right insurance lets you enjoy your vehicle without worrying about unexpected costs or risks.

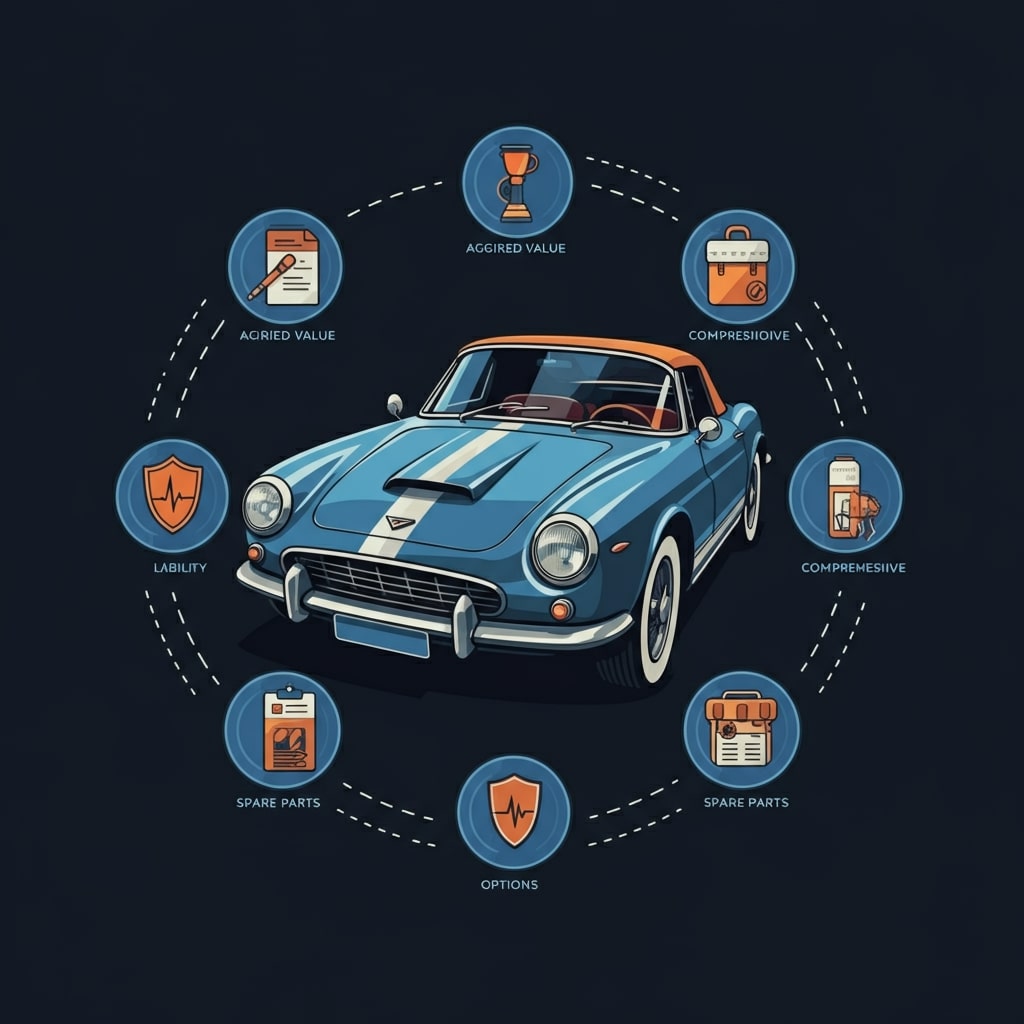

Types of Coverage in Collector Auto Insurance

Collector auto insurance offers a range of coverage types tailored to the needs of classic and rare car owners. Below are the main options to consider:

1. Agreed Value Coverage

This is a hallmark of collector car insurance. Unlike standard auto coverage, which often reimburses based on depreciated value, agreed value coverage determines a mutually agreed-upon value that you will be compensated for if the car is stolen or totaled. This ensures you receive the full declared worth of your vehicle.

2. Liability Coverage

Just like standard auto insurance, liability coverage protects you financially if you’re found at fault in an accident that causes injury or damage to someone else's property. However, liability policies for collector cars often take into account their restricted use.

3. Collision Coverage

This covers the cost of repairing or replacing your vehicle following an accident, regardless of who is at fault. Since repairs on collector vehicles often involve more time, effort, and specialist mechanics, collision coverage is an essential inclusion.

4. Comprehensive Coverage

Comprehensive protects your car from non-collision events, including:

- Theft

- Fire

- Vandalism

- Natural disasters like hailstorms or floods

This coverage is crucial for high-value vehicles, especially those stored in areas prone to adverse weather conditions or potential theft.

5. Spare Parts Coverage

Collector cars often rely on rare and sometimes custom-made parts for maintenance. Spare parts coverage provides compensation for the loss or damage of those hard-to-find parts, ensuring you’re not out-of-pocket for costly repairs.

6. Roadside Assistance

Exclusive to some collector car insurance policies, roadside assistance covers towing and emergency help for your collector car, ensuring it's handled with care when issues arise.

7. Limited-Use Policy Coverage

Since collector cars are rarely used for commuting, you can opt for mileage-limited policies. These policies reflect the lower risk associated with occasional use, thus reducing premiums.

8. Trailer Coverage

Some collectors haul their vehicles to exhibitions or shows. Trailer coverage ensures protection against damages to both the trailer and the car during transport.

Factors Affecting Collector Auto Insurance Premiums

Collector car insurance policies are highly customized, which means premiums can vary significantly. Here are the main factors:

1. Type of Vehicle

The make, model, year, and rarity of the car directly impact insurance costs. Vintage Ferraris or limited-edition Mustangs, for example, cost more to insure than more common classics.

2. Agreed Value

The agreed value you and your insurer settle on determines the policy's compensation limit and can significantly influence premiums.

3. Usage

How frequently you use and display the vehicle matters. Policies for cars used only occasionally for parades or shows tend to have lower premiums than those you drive on a semi-regular basis.

4. Storage Location

Keeping your vehicle in a secure, climate-controlled location like a locked garage reduces premiums compared to leaving it in an open or unmonitored space.

5. Driving History

A clean driving record and limited history of at-fault accidents positively impact insurance costs.

6. Coverage Level

Additional coverage options, like spare parts or trailer protection, and higher coverage limits can drive up premiums. Selecting only necessary add-ons can help control costs.

7. Memberships and Certifications

Some insurance providers offer discounts to members of collector car clubs or participants in certified driving courses.

8. Region

Locations with higher theft rates or severe weather conditions may lead to higher premiums.

9. Insurer Reputation

Different insurance providers may have varying approaches to premiums and benefits for collector cars. Comparing providers and their specializations can make a big difference.

How to Choose the Right Collector Auto Insurance Policy

Finding the perfect policy for your prized car isn’t just about the lowest price—it’s about ensuring complete and adequate protection. Here’s how to choose:

- Evaluate Your Needs

Assess the car’s usage, value, and your financial requirements, including whether you need add-ons like spare parts or trailer coverage.

- Compare Insurers

Research providers who specialize in collector car insurance. Use online tools or reach out for personalized quotes. Customer reviews and claim responsiveness can also impact your decision.

- Understand Coverage Options

Go beyond standard liability and include comprehensive coverage that aligns with the specific risks your car faces, such as theft or rare parts replacement.

- Check for Restrictions

Some policies come with restrictions on mileage, vehicle use, or who can drive the car. Ensure these terms align with your needs.

- Request Discounts

Whether bundling policies or being part of a car club, explore all possible discounts and cost-saving measures to maximize value.

- Read the Fine Print

Understand your policy’s exclusions and limitations, like what may not be covered under certain conditions.

- Consult Experts

If in doubt, consult insurance agents or experts specializing in collector cars for tailored advice.

Tips for Saving on Collector Auto Insurance Premiums

- Store Your Vehicle Securely

Opt for a monitored and climate-controlled storage space to reduce theft or damage risks, often resulting in lower rates.

- Limit Annual Mileage

The less your vehicle is on the road, the lower the risk, translating into savings.

- Bundle Your Policies

Combine home, auto, and collector car insurance with the same provider for a potential multi-policy discount.

- Customize Your Coverage

Opt only for coverage you truly need—like agreed value and spare parts protection—while dropping unnecessary add-ons.

- Take Advantage of Membership Benefits

Join collector car organizations that partner with insurers to offer lower premiums or exclusive benefits.

- Shop Around Annually

Competitive pricing requires regular comparison of policies. Providers may change rates or offer new incentives.

- Maintain a Clean Driving Record

Safe driving leads to lower premiums, as insurers reward clients with a low-risk profile.

- Invest in Anti-Theft Devices

Advanced anti-theft systems protect your car and improve your insurance rates.

The Collector Auto Insurance Claims Process

Filing a claim for a collector car follows specific steps to ensure successful reimbursement:

- Document the Damage

Take detailed photos of the car’s damage and collect all relevant information, including police or eyewitness reports.

- Notify Your Insurer

Contact your insurance provider as soon as possible, providing all requested evidence and documentation.

- Work with an Adjuster

An adjuster will assess the damage and determine coverage based on the agreed-upon value of your vehicle.

- Repair or Replacement

Repairs are typically handled by specialized auto shops familiar with collector cars. Replacement or total-loss payouts adhere to the agreed value in your policy.

- Follow-Up and Review

Keep communication ongoing and resolve any delays by submitting additional data if required.

FAQ About Collector Auto Insurance

1. Do I need collector auto insurance for every classic car?

Yes, if the car's value exceeds the standard market rate or has unique collectible characteristics, specialized insurance ensures better protection.

2. How is collector auto insurance different from regular auto insurance?

Collector insurance considers agreed value, limited usage, and storage conditions, whereas regular insurance depreciates value and assumes daily use.

3. Can I still drive my collector car regularly?

Collector policies generally include mileage restrictions. Check specific policy terms to gauge permissible use.

4. Does collector car insurance cover restoration?

Restoration often requires additional coverage or riders to protect the car during the work process.

5. How do I find insurers specializing in collector cars?

Research online, consult collector clubs, or seek recommendations from fellow enthusiasts.

6. Are customizations covered?

Yes, but you may need to purchase additional coverage to account for aftermarket modifications.

7. Can older daily drivers qualify for collector insurance?

Eligibility depends on age, rarity, and condition. Well-maintained older cars may qualify if they’re considered collectibles.

8. Is spare parts coverage necessary?

If your car relies on rare or imported parts, spare parts coverage is a worthwhile addition.

Collector auto insurance combines tailored protection with peace of mind, letting you enjoy your cherished vehicle to the fullest. With careful planning, you can find the right policy to secure your investment and passion for years to come.